Evaluating your pay cycle strategy to gain efficiency and help your people

Content

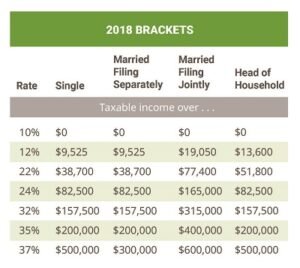

They will, however, be able to submit their timesheet whether or not their total logged hours exceeds the set criteria. If the setting is enabled, the user will be prompted with an alert if their total logged hours is less than the minimum hours set. They will, however, be able to submit their timesheet whether or not their total logged hours meets the set criteria. Select this checkbox if you want the software to annualize the standard pay plus the bonus amount to determine the Federal income tax amount, otherwise leave this checkbox clear.

- Check the Fair Labor Standards Act regulations to ensure that identify employees who are classified as nonexempt and paid overtime requirements.

- As a Genesis Agent, you will receive a pay stub from your Square Payroll account between one and five days prior to payday.

- All ten hours cannot be counted at a 1.5 x rate, because this would be duplicitous to the five hours already paid the 1st through the 15th.

- Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

Only timer and start and end time logs under the ‘Log time using’ setting will be pushed to attendance. Once ‘Include Paid Leave’ is enabled, paid leave will be reflected in the payroll report. You can enableInclude Paid Leaveto include paid leave as part of your payroll calculations. If the timesheet goes for approval, the approver will also receive an alert indicating that the user has exceeded the set maximum hours criteria. This information will be useful for the approver before they approve or reject the timesheet. If the timesheet goes for approval, the approver will also receive an alert indicating that the user has not met the set minimum hours criteria.

Deciding to Change Your Payroll Frequency

I don’t know how to complete the function from my dashboard. If you need to make a wire transfer , contact Customer Support and we will provide you with information on when and how to wire funds. We cannot divulge wire thresholds for security reasons. Beginning January 1, 2021, the Federal Retirement Thrift Investment Board implemented a new method for catch-up contributions called the “spillover”. Spillover will apply to all active employees who are at least 50 years of age, or older, and exceed the IRS annual deferral limit.

- The Payroll Calculation Tool uses this value when calculating the pay at the old rate.

- If you have not started the W2 Preview or you are logged in to your W2 Preview Company Contact page, you can make the necessary change.

- This, however, can be risky; for example, if an employee leaves your company without making adjustments, they will not pay back the estimated hours.

- Enter a new pay frequency code to apply to the employee.

In the comments box, Configuring A Pay Cycle For Projected Payroll the hourly, salary, or earning name, wage amount, any taxes and amounts, and the check date when the wage change took place. Dental and vision coverage authorized in 2022 automatically continues in 2023, though some premiums may change for 2023. For additional information, to view the new rates or make open season changes, employees can go to

Step 5: Add a workers’ comp policy to your QuickBooks account.

Please contact https://adprun.net/ and we will guide you through the process. Be aware that you need to select this option before W2s and 1099s are posted online or you will be charged for the change. Consumers are required to pay applicable state taxes on top of, and at a certain percentage of, the sales price of the taxable goods and/or services they buy. The taxable clergy payroll is used to pay Federal and State taxes based on IRS Publication 517.

- Bi-weekly is the most common length of pay period identified by the U.S.

- From the pay period end date, employees should receive their money within five days.

- In the comments box, enter the hourly, salary, or earning name, wage amount, any taxes and amounts, and the check date when the wage change took place.

- The system uses the value in the Description 02 field on user defined codes to calculate the amount per pay period for a salaried employee.

For more information about Workers’ Compensation under the U.S. Be aware that SurePayroll is not responsible for paying taxes on prior-to-service payrolls nor are we responsible for filing prior completed quarters. SurePayroll will only make quarterly tax payments and filings for the quarter you processed your first check date with us. We occasionally select random clients to take our NPS survey following payroll processing.

Digital wallets take 1-2 days

To your referral program account at any time to view and track your referrals. As of 2019, states that have no state withholding include AK, FL, NH, NV, SD, TN, TX, WA and WY. With online bank changes, we now require a voided check or bank letter from some clients instead of the DAV form. Please contact Customer Support for information regarding which Box 12 codes we support.

The employer will generally deliver payroll checks to the employee on the following Friday. Bi-weekly is common for both salaried employees and hourly workers. If you cannot align your new frequency with your old frequency, you may need to make some adjustments with your employees’ pay.

Leave a Reply